[By Akshita Bhansali & Niharika Agarwal]

The authors are students of Gujarat National Law University.

Background

In the backdrop of several tax evasion and money laundering cases, upon the recommendations of the Joint Parliamentary Committee on Stock Market Scam, the Ministry of Finance introduced the Companies (Restriction on Number of Layers) Rules, 2017 (“Layering Rules”) for more transparency. The Layering Rules restrict companies from having more than 2 layers of subsidiaries, counted vertically, subject to certain exemptions. However, linguistic ambiguities in the Layering Rules have created confusion among legal practitioners and academicians alike, which despite abundant pleas have not been clarified.

To complicate matters further, in 2022 the Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”) along with Regulations and Directions issued by RBI, established a new framework for overseas investment including the setting up of subsidiaries or joint ventures abroad. These rules introduced a relaxation, permitting what was restricted in the earlier regime as ‘round tripping’ i.e., investment in a foreign entity that directly or indirectly invests in India. But this move comes with a restriction under Rule 19(3) of OI Rules, 2022 that such an investment in a foreign entity must not result in a structure of more than 2 layers of subsidiaries. In this provision, though the OI Rules reference the Layering Rules, it is replete with ambiguities as to how their differing provisions interplay in practical application for any business entity. This blog intends to identify these ambiguities through hypothetical scenarios of company structures and provide specific resolutions for the same through the aid of rules of statutory interpretation.

Scenario 1: Exception to Foreign Subsidiaries

The Layering and OI Rules adopt differing approaches when it comes to counting of foreign subsidiaries on account of their different regulatory purposes. The Layering Rules introduce a provision to the effect that the layering restrictions shall not affect the acquisition of foreign subsidiaries, thereby omitting them from the computation of layers. Such a concession is not granted by OI Rules which were formulated primarily to address intricacies in foreign investment structures and promote legitimate business activities by imposing restrictions on specific FDI – ODI arrangements. Therefore, omission of foreign subsidiaries would strike at the very heart of the OI Rules’ provisions.

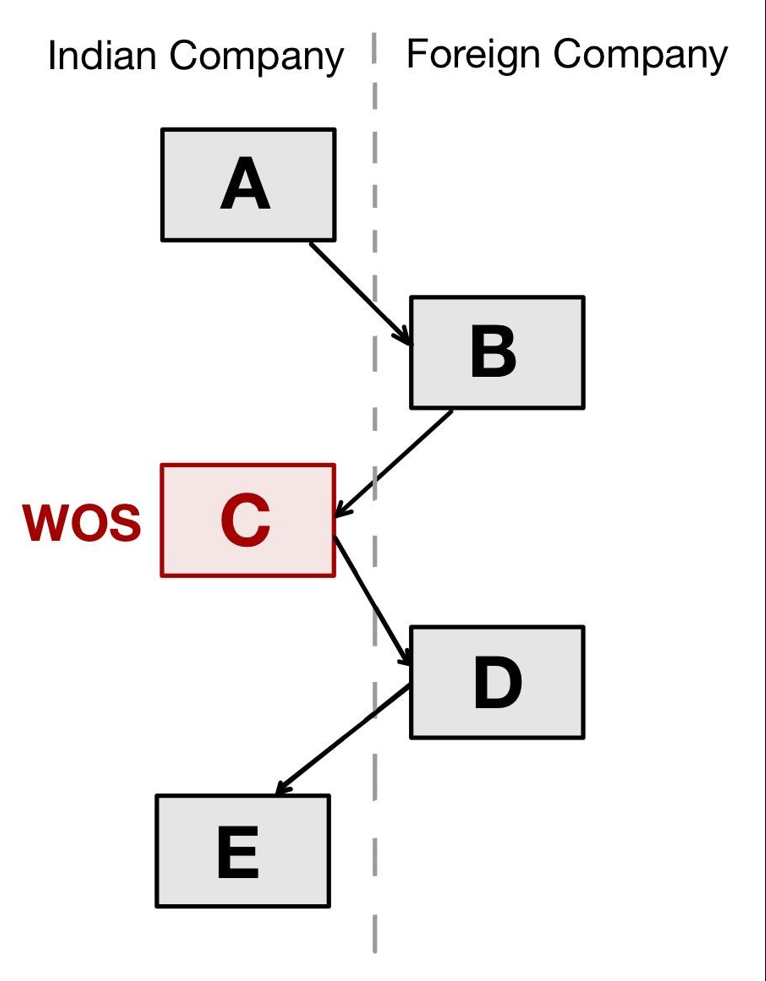

Keeping this dissimilarity in mind, consider the scenario of an Indian parent entity “A”. Its foreign subsidiary “B” would be excluded from computation by the Layering Rules, but in the realm of OI Rules would be considered as the parent (the reasoning for which is discussed in Scenario 2). Consequently, its Indian subsidiary “C” would form the first layer under both regulatory frameworks. However, complications arise with a subsequent foreign subsidiary “D” classifying as the second layer under OI Rules but accorded exemption under Layering Rules. Now, another Indian subsidiary “E” forming the second layer under Layering Rules yet is barred under OI Rules on account of the restriction of 2 layers. This presents an ambiguity wherein a structure explicitly permitted under Layering Rules on account of the exemption, becomes violative of OI Rules.

Fig. 1: Ambiguity in treatment of Foreign Subsidiaries

To navigate this quandary, the Doctrine of Lex Specialis, a principle of statutory interpretation favouring specialised laws over general ones, assumes relevance. Legal precedents like Ram Parshotam Mittal vs. Hotel Queen Road Pvt. Ltd. and Union Of India vs M/S.Kiran Overseas Ltd. establish the precedence of FEMA as a special law over the Companies Act and their respective rules. Applying the same in the current context, OI Rules prevails over the exemption granted by the Layering Rules. Consequently, subsidiary “E” would not be permitted, aligning with the more stringent constraints dictated by OI Rules. This approach ensures consistency in regulatory interpretation while maintaining the integrity of cross-border corporate structuring.

Scenario 2: Determination of Parent Company

Another key distinction is the determination of the entity being considered as the parent company from which the subsidiary layers are counted which also creates a dissonance in counting of layers for compliance, which can be properly addressed through the use of harmonious construction of their provisions for compliance of both laws simultaneously. While the Layering Rules intuitively considers the first Indian Company “A” as the parent company, the OI Rules seem to follow a different pattern. It is important to note that amongst academia there exists an equivocation on the question of determining the starting point for calculation of layers under the OI Rules. However, clause (15) of the ‘Instructions for filling up the Form FC’ in RBI’s Master Directions on Reporting under Foreign Exchange Management Act, 1999 clarifies that for the purpose of calculation, the foreign entity shall be treated as the parent, with a subsidiary directly under the foreign entity being treated as first layer and so on.

This diverged position creates a problem in determination of allowance of subsidiaries. For instance, Indian company “A” has subsidiary “B” which has a subsidiary “C” forming layers 1 and 2 respectively in India. “C” sets up a foreign subsidiary “D” through ODI which would not be affected by Layering Rules but would form the parent company for the purposes of OI Rules. Now if “D” were to choose to set up an Indian subsidiary “E”, under OI Rules this would be permitted as the first layer but would clearly breach the limits of the Layering Rules by classifying as a third layer.

Fig. 2: Determination of Parent Company and counting of layers thereof.

In such a scenario it is important to keep in mind that when interpreting the different positions of the two laws, they cannot be interpreted so as to reduce the provision of any Statute or Rule as redundant. This can be ensured by adoption of the Doctrine of Harmonious Construction as laid down in Commissioner of Income Tax v. M/S Hindustan Bulk Carriers by giving an effective interpretation and upholding the regulatory objective of both law. The ambit and purpose of FEMA being limited to regulating foreign investment and the flow of currency across jurisdictions, cannot defeat the purpose of prevention of tax evasion for which the Layering Rules were set up specifically for Indian companies. Therefore, despite it being a special law and following a different method of calculating layers, its rules must be read in their relevant context and not mischievously taken to circumvent regulation under Companies Act provisions. Therefore, in this scenario, subsidiary “E” must not be permitted.

Scenario 3: Divergent definitions of control

Additionally, a subsidiary company refers to an entity that is controlled by another company, known as the parent company, or holding company. Given that control is exercised through the possession of voting rights beyond the prescribed threshold, it forms the basis of classification as ‘subsidiary’. In this regard, the divergent thresholds for defining “control” as stipulated by the OI Rules and the Companies Act have introduced a perplexing conundrum. Under Rule 2(1)(c) of OI Rules, “control” is invoked when voting agreements confer 10% or more voting rights. This contrasts sharply with Section 2(87) of the Companies Act, 2013, where control is predicated on 50% or more voting rights or the right to appoint majority directors. This intricacy manifests vividly in a scenario involving an Indian parent entity “A,” holding 50% voting rights in foreign company “B” exempted under Layering Rules. Subsequent subsidiaries “C” and “D” respectively form layers 1 and 2. Now, if “D” commands 10% voting power in an Indian entity “E”, it will be counted as a third layer and violate OI Rules but will not fulfil the criteria of a subsidiary under Companies Act.

Fig. 3: Effect of divergent definitions of control

FEMA, crafted from an investment-focused perspective, aims to extend the scope of regulation by lowering the threshold of investment sufficient to attract the restrictions. This approach, however, gives rise to a discrepancy in terminology. The utilisation of the term “subsidiary” generally signifies those entities whose decision making is influenced, and clear control exists, which is not convincingly the case with just 10% voting rights. Thus, a 10% standard generates confusion and appears out of place to be defined as “subsidiary”. A recommended approach is to avoid the term having different connotations in Companies Act, substituting it with clearer alternatives. This strategic interpretation aligns with the overarching objective of achieving coherent regulatory clarity.

Scenario 4: Exception to Wholly Owned Subsidiary

Lastly another key discernment is the exemption provided for any one layer containing one or more Wholly Owned Subsidiaries (“WOS”) under the Layering Rules. While the OI Rules have explicitly included the other exemption provided to Government, Banking, NBFC and Insurance Companies under the Layering Rules, it remains silent on the application of the WOS exemption in calculation of subsidiaries.

Fig. 4: Consideration of Wholly Owned Subsidiary

The rationale or legislative intent for not including the exemption as a proviso to the section under the OI Rules also remains unclear which until further clarification from the RBI would have to be read to not exist under the OI Rules. As per the Supreme Court’s decision in M/s Ram Narain Sons Ltd. v. Asst. Commissioner of Sales Tax and Ors. the proviso to a section is to be strictly interpreted and does not travel beyond the provision to which it is a proviso. Hence, interpretative rules here would not allow for an exemption to be read in, and its exclusion must be volitional. In effect this would cause for the more restrictive application of the provisions of OI Rules to have an overriding effect and prevent the setting up of a third layer of subsidiaries by omitting a layer with a WOS.

Conclusion:

While this blog aims to address some of the interpretive issues that arise in the implementation of the OI Rules where it overlaps with the Layering Rules, it only touches the tip of the iceberg. The complexities enveloping the elucidation of “any one layer” within the context of the WOS exemption, the enforcement of OI Rules vis-à-vis future investments by foreign companies violating layering restrictions, and the pending matter related to common control of directorial boards across layers remain territories awaiting illumination. Besides these unresolved issues in the language of the regulations individually, their intersection underscores the necessity for legislative foresight to preclude interpretive discord and overlaps. This could be achieved by the inclusion of explanations in the OI Rules explicitly stating that its provisions hold notwithstanding the exemption to foreign subsidiaries in the Companies Rules, and the non-applicability of exemption to WOS while also using a different term from “subsidiary” for prevention of confusion. In this manner, a harmonised regulatory landscape is imperative to balance regulatory stringency with legal clarity, fostering a conducive environment for business conduct and compliance.