[By Chytanya S Agarwal]

The author is a student of National Law School of India University, Bangalore.

I. Introduction

The rationale behind Reverse Mortgage Loans (‘RMLs’) is to ensure adequate retirement income for senior citizens, whose wealth is majorly confined in the form of home equity, . RMLs are essentially the ‘reverse’ of conventional mortgages and entail periodic payments from the mortgagee (and not the mortgagor) for several decades. Under RMLs, the mortgagor is permitted to reside in his/her mortgaged property and there is no obligation to service the debt during one’s lifetime. When the mortgagor dies or the RML ends due to other reasons (contractual or statutory), the mortgagee has the right to recover the mortgage money by liquidating the mortgaged home. RMLs are normally provided only to senior citizens since their wealth is majorly confined in the form of home equity and, thus, is illiquid. They are the most suited for them due to their inadequate current income, lower remaining lifetime, and tax incentives (Rajagopalan, pp.3-4). Particularly popular in developed nations with a pro-house ownership stance, RMLs ensure the release of locked private wealth for stimulating consumption and bearing old-age expenses like nursing and medical costs.

In a context where RMLs are being mooted as an attractive source of retirement income (see here, here and here), in this article, the author argues that the current RML regulations in India are fraught with inconsistencies and employ a model of regulation that hightens market risks instead of mitigating them. To make this argument, firstly, I would explain the features, rationale, and risks associated with RMLs through a brief literature review; secondly, I would highlight the internal inconsistencies and ambiguities in the provisions governing RMLs in India and analyse their implications; and lastly, I espouse the ‘product governance’ model of regulation as the ideal approach for mitigating the risks intrinsic in the RML market. To make that argument, I would juxtapose Indian RML regulations with those of the US and delve into the theories of financial regulation.

Kindly note that this article synonymously uses the terms ‘borrower’ and ‘mortgagor’, and ‘lender’ and ‘mortgagee’.

II. Explaining RMLs – Characteristics, Rationale, and Risks

A. Characteristics of RMLs

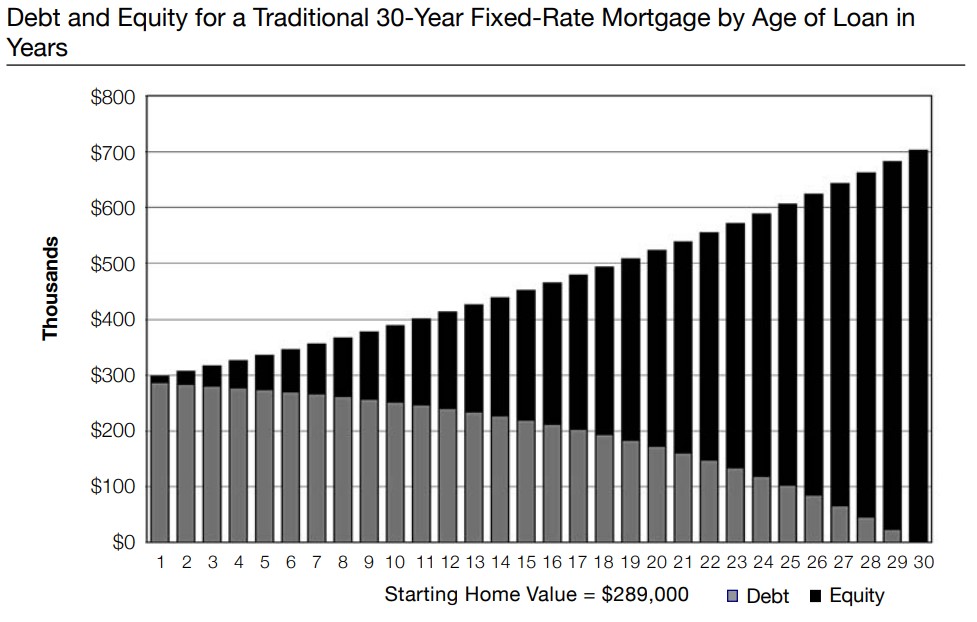

RMLs, as explained, are the opposite of traditional mortgage loans as, in RMLs, it is the lender and not the borrower who makes periodic payments (or gives a lump-sum or line of credit) for a fixed period of time or till the latter’s death. The borrower is not bound to service such debt during his/her lifetime. The mortgage money is recovered by the sale of the property at the end of the borrower’s lifetime, although his heirs have the right to redeem the mortgaged property before its sale. It is considered extremely attractive source of income for senior citizens who are ‘house-rich’ but ‘cash-poor’. Per Syzmanoski (pp.6-10), due to the lack of periodic debt servicing, RMLs are characterised by ‘rising debt’ and ‘falling equity’ – which is the reverse of what happens in a conventional mortgage (see Figures 1 and 2). They are also non-recourse loans, implying that nothing beyond the value of the mortgaged home can be recovered by the mortgagor (see here and here).

Figure-1 (Conventional loan): This graph shows that conventional mortgages have falling debt and rising equity.

Figure-2 (RML): This graph shows rising debt and falling home equity in an RML.

B. The economic rationale underlying RMLs

Understanding RMLs involves delving into economic theories such as Modigliani’s Life Cycle Hypothesis (‘LCH’) and Friedman’s Permanent Income Hypothesis (‘PIH’) which argue that people tend to smoothen their consumption over the course of their lifetime. Modigliani (pp.305-306) posits that people save part of their income as wealth until retirement. After they retire, they dissave their accumulated savings (or wealth) for maintaining the same level of consumption till the end of their lifetime (see Figure-3). LCH can properly explain the purpose behind RMLs. This is because in RMLs, senior citizens subsequent to retirement follow LCH by expending their accumulated wealth or home equity (and, thus, dissaving) to source income for their remaining life (Sehgal, pp.170-171). Similar conclusion can be reached using PIH because of the income-smoothening rationale of RMLs (see Baily et al, p.24 and Bergman et al, p.27).

Figure-3 (Life Cycle Hypothesis and RMLs): The graph shows how individuals maintain the same level of consumption throughout their lifetime. They save part of their income as wealth until their retirement. The triangle depicts rising wealth till retirement. Upon retirement, this wealth is expended/dissaved till the end of lifetime. RMLs work as a mechanism that gradually dissave this self-acquired wealth (in the form of home equity) to maintain a constant level of consumption.

C. Risks associated with RMLs

Cross-over risk is the principal concern faced by RML lenders (Wang et al, p.346). It happens when the value of the loan exceeds the property’s value. It can happen due to three reasons (see Syzmanoski, pp.351-345): (a) the unexpected longevity of the borrower (Bank for International Settlements, pp.8-13), (b) fluctuating interest rates, and (c) when the property’s value did not rise as expected. Risk-averse lenders take mortgage insurance to avoid such losses (Syzmanoski, pp.347-349). In addition to the cross-over risk faced by lenders, borrowers also face longevity risk in fixed-term RMLs since they (and their spouses) face the risk of eviction on early loan termination. This can happen when the RMLs have a fixed period and this period does not extend till the end of the borrower’s lifetime. In addition, although most borrowers seem to favour lump-sum RMLs with fixed exchange rates, these are considered riskier than the other remaining modes of disbursing RMLs, namely, annuities and floating interest rates (Fuente et al, p.185). Moreover, the costs and interest rates of RMLs are generally higher than those of conventional loans (see Jakubowicz, p.184 and here).

III. Indian RML Regulations: Inconsistencies and Blind-spots

The Central Board of Direct Taxes introduced the Reverse Mortgage Scheme (‘RMS’) through a notification under Section 47(xvi) of the Income-tax (Amendment) Act, 2008, (‘the ITA’) which exempts RML transactions from capital gains tax. In addition, Section 10(43) of the ITA excludes lump sums, instalments, and credit extended under RML from the definition of ‘income’. Under rule 2(h) of RMS, the definition of ‘reverse mortgage transaction’ excludes alienation of property for settlement of the loan. Thus, as per ITA and RMS, a mortgagor under RML is liable to income tax only at the time of the sale of property by the mortgagee for debt recovery. This is because RMLs differ from such transactions as their underlying intention is to secure a channel of income flow against a residential house’s mortgage and not to alienate the property.

RMS lays down rules regarding the eligibility of mortgagors[1] and the mode of disbursement.[2] In addition, it limits the period of all RMLs to 20 years in case of disbursement via lump-sum and instalments.[3] Pursuant to RMS, the National Housing Bank (‘NHB’) also released guidelines (‘NHB guidelines’). The NHB guidelines are of mandatory nature for banks since the NHB derives this power from Section 14(k) of the National Housing Bank Act, 1987. In India, only “self-occupied and self-acquired” residential property in which the borrower currently resides can be mortgaged under RMLs.

However, there exist inconsistencies in the provisions of RMS and NHB guidelines (‘the Indian RML Regulations’). In this section, I highlight such inconsistencies and then briefly outline their implications on the Indian RML market. Thereafter, I argue that Indian regulations do not imbibe learnings from other jurisdictions (like the US) that have a long-standing experience in regulating RMLs and this aggravates the cross-over risks (rather than mitigating them).

A. Personal liability of the Borrower

It is unclear as to whether the Indian RML regulations retain the ‘non-recourse’ character of RMLs. As explained earlier, the non-recourse feature of RMLs implies that the mortgagor will never be held personally liable for any sum exceeding the value of the mortgaged property during foreclosure. Rule 7 of RMS, for instance, makes the mortgagor or, in his absence, his legal heirs responsible for the repayment of the mortgaged money during the foreclosure of the RML. Thus, RMS prima facie creates personal liability for mortgagors and their heirs to service the debt upon loan termination. However, this directly contradicts Rule 16 of the NHB guidelines which mandates all the PLIs to provide a ‘non-recourse’ or ‘no negative equity’ guarantee so that the mortgagor shall be liable for no more than the ‘net realizable value’ of the mortgaged property. Thus, as per NHB guidelines, then there should be no personal liability of the borrower to satisfy the debt. These conflicting (and thus, unclear) rules can lead to moral hazard, where mortgagee-banks are assured that the mortgagor will have personal liability even when the mortgaged property’s value doesn’t cover the debt. Abandoning RMLs’ non-recourse nature, which is known to provide security to the borrowers (see here and here), can also expose mortgagors to greater risks.

B. The duration and mode of disbursing RMLs

Moreover, the NHB Guidelines haven’t been updated to comply with the Reverse Mortgage (Amendment) Scheme, 2013 (‘the 2013 Scheme’). For instance, the 2013 Scheme provides for lifetime RMLs (which is not limited to 20 years) in case the disbursement is by way of annuities.[4] However, the NHB guidelines has not been revised correspondingly and they still restrict all RMLs to a term of 20 years.[5] The RBI guidance, on the other hand, disallows RMLs for a period exceeding 15 years. Under NHB guidelines,[6] disbursement by way of annuity or line of credit is still not an option though it is allowed by the 2013 Scheme. This omission to include annuities can aggravate the risks faced by consumers because, as mentioned earlier, disbursement of RMLs by way of annuities is considered less risky for borrowers vis-à-vis disbursement via lump-sums (see US Congress report, pp.93-113, 133-140 and Fuente et al).

In India, the Primary Lending Institutions (‘PLIs’) which are governed by the NHB guidelines also have the discretion to decide the duration and mode of disbursing of RMLs, irrespective of the choices of the borrowers.[7] Moreover, lump-sum payments are restricted to only emergency medical expenses.[8] On the contrary, it is a settled practice in other jurisdictions (like the US) to give the consumer the choice of deciding the mode of disbursing RMLs. Lack of consumer choice, combined with the risk-averse behaviour of mortgagee-banks, has adversely affected borrowers who are otherwise considered eligible and credit-worthy. Dealing with such lender attitudes, the Allahabad HC, in Dheer Singh v. Union of India (¶13), ruled that such denial of RMLs on account of considerations that favour the mortgagee is “grossly illegal, arbitrary and unjust.”

C. Consumer protection, disclosures, and conflict of interest

Avoiding asymmetric information is one of the principal rationales of financial regulation (Llewellyn, pp.21-22, 25). I argue that the Indian RML regulations are inadequate to prevent informational asymmetry between mortgagor-consumers and mortgagee-banks.

For instance, the PLIs do not have clear disclosure obligations under NHB guidelines apart from Rules 3, 4, and 20 of the NHB guidelines which does not specify the particulars that need to be disclosed apart from the nature of the RMLs and the calculations involved. The NHB guidelines. In contrast, jurisdictions like the US where RMLs originated employ more extensive and detailed disclosure requirements to ensure transparency in the RML market (see US Congress Report, pp.101-105).

Similarly, mortgagees in the US must ensure that prospective mortgagors are given independent, third-party counselling before they subscribe to RMLs (Jakubowicz, pp.195-197). Independent counselling ensures that the counsellors do not become salespersons who persuade the customers to buy their RML products. Instead, it ensures that customers receive impartial advice to make informed decisions. Moreover, unfair practices such as bundling are prohibited by RML laws in the USA.[9] In India, by contrast, the PLIs themselves give counselling services to mortgagees.[10] This leads to a potential conflict of interest since the mortgagees themselves would be counselling their customers. Additionally, under the Indian RML regulations, there is no independent overseeing regulatory authority mandated to ensure compliance with the disclosure and counselling requirements. In contrast, the Federal Housing Administration (‘FHA’) acts as the regulator of the Home Equity Conversion Mortgage (‘HECM’) market or the RML market in the US.[11]

Moreover, the contract law regime in India does not recognise substantive unconscionability as a ground for nullifying contracts. Rather, Indian laws, on the other hand, only recognise procedural unconscionability (see Mohan et al, pp.11-13, and 199th Law Commission Report). In contrast, jurisdictions like the USA have additional safeguards for borrowers in the form of other laws recognising substantive unconscionability as a ground for the unenforceability of the contract.[12] Consequently, the US courts have invalidated several RML claims on the grounds of substantive unconscionability.[13] The absence of such legal provisions exposes Indian RML mortgagors to greater risks.

D. Need for governmental intervention to hedge against risks

In the US, the FHA is mandated to provide insurance to mitigate losses in case of borrowers’ default.[14] On the contrary, apart from the minimalistic regulation by NHB and RBI, India has no regulator empowered to intervene in the RML market to insure against such risks and losses of the parties involved. For the same, under the HECM, the FHA is given Monthly Insurance Premiums (see Congressional Budget Office, pp.5-7 and Home Equity Conversion Mortgages Handbook, p.12). In several judgements, the US Courts have used the this provision to hold the Department of Housing and Urban Development (‘HUD’) liable for covering up the losses in an RML transaction. For instance, in Bennett v. Donovan, the facts dealt with the eviction of the deceased borrower’s spouse since the mortgagee had right to sell the mortgaged property upon the borrower’ death. In its judgement, the Court of Appeal directed the HUD to accept the loan assignment and pay off the loans to prevent such foreclosure. This gave relief to both parties from the inherent risks in RML. While it does push up the cost of RMLs due to high regulatory costs, it federally insures lender default (see Stark et al, pp.317-318).The absence of such provisions in the Indian context exposes both parties to greater cross-over risks.

IV. The Desired Method of Regulating RMLs

In the previous section, I showed how the Indian RML regulations do not effectively perform their objective of reducing informational asymmetry. In this section, I would argue that the Indian model of regulating RMLs should not be limited ensuring informational symmetry (through counselling augmented by disclosures). Rather, by showing that merely reducing informational asymmetry does not negate cross-over risks, I argue in favour of a different regulatory stance.

Ryan classifies RML regulatory policies under under three heads – minimalist, interventionist, and procedural. Per Ryan (p.211), the US model adopts the minimalist approach. It is minimalist since it largely seeks to rectify informational asymmetries through through independent counselling augmented by disclosures, and provides insurance only with the consent of the mortgagor and the mortgagee. Based on the previous discussion, it can be implied that the Indian RML regulations are on a weaker footing than that of the US due to weaker disclosure and counselling requirements, and lack of insurance requirements. However, merely amending the regulations to ensure transparency does not adequately protect against risks intrinsic to RML market. For instance, as shown by Schnieder, mandated disclosures need not necessarily lead to right consumer choices (pp.711-728) but can have unintended harms (pp.737-742). Moreover, disclosures regarding RML evaluations are highly complex and offer little guidance.[15] Theorists have argued that even the clearest information cannot prevent behavioural shortcomings (e.g., biases) in consumer decision-making (Armour et al, pp.329-332). Additionally, the introduction of state-backed insurance is not feasible due to high costs (see Ahlstrom, p.7, and here).

In conclusion, Ryan (pp.213-214) proposes the ‘procedural’ regulatory model as the suitable model for regulating RMLs. It shifts the focus from ‘product regulation’ to ‘product governance’ by focussing on product design and stress testing. While ‘product regulation’ mandates disclosures and restricts the substantive terms of financial contracts, it does not target potential market failures caused by poor consumer choices (Armour et al, pp.402-404). ‘Product governance,’ on the other hand, requires firms, as a procedure, to tailor their products after researching into account consumer behaviour of their targeted markets. The products must be tailored in a manner to remove anything detrimental to consumer interests (Armour et al, pp.405-406). In fact, product governance is considered to be the most ideal approach for regulating consumer financial products (Armour et al, p.412). Thus, per Ryan, product governance can negate the risks posed by the RML market at the product development stage itself. As an illustration, product governance in Japan has mitigated cros-over risks and even facilitated the development of less risky alternatives to RML, such as the “real property trusts” (Ryan, p.219). The adoption of product governance in Eurpoean and Australian RML markets is also known to have reduced the risks associated with the product (see OECD, pp.52-53 and Australian Securities and Investment Commission, p.28). Thus, reforming Indian RML regulations on these lines would ensure that the risks are minimised at the pre-transaction stage itself. This form of regulation is also cost-effective since it would lower the risks at product design stage and thereby negate the need for state-funded insurance.

V. Conclusion

Currently, RMLs are not so popular in India due to several reasons such as bequest motive, exclusion of ancestral property from RMLs, higher interest rates, and the inability to rent the mortgaged property (see here, here, and here). Other reasons include the lack of awareness and the inability to understand the complexities of RMLs.

As per the National Policy on Senior Citizens, the elderly population in India is slated to rise by around eight times between 2000 and 2050. It also envisages secure income for the elderly while framing policies for “Ageing in Place” (p.4) – both of which can be satisfied by RMLs. Given the rise in silver economy, the Indian RML market would expand in the near future, further strengthening the need to revamp its regulatory model to work against future risks. As highlighted by this paper, the current Indian RML regulations suffer from internal inconsistencies and should also adopt learnings from other jurisdictions to protect players (both the mortgagors and the mortgagees) in this market. The regulatory policy must take a procedural stance and require mortgagee-banks to provide safer alternatives to pre-empt risks.

[4] The 2013 Scheme, Rule 6(ii)

[5] NHB guidelines, Rule 6.

[6] NHB guidelines, Rule 4,6.

[7] NHB guidelines, Rule 12.

[8] NHB guidelines, Rule 4.

[9] United States Code, s1715z-20(o).

[10] NHB guidelines, Rule 20.

[11] United States Code, s1715z-20.

[12] For instance, see California Civil Code, s1670.5 on ‘unconscionable contract’.

[13] The rule of unconscionability was used for RMLs in Flores v. Transamerica HomeFirst Inc [2001 Cal. App. LEXIS 1560]. For the application of Contra Proferentem rule to RMLs, see James B. Nutter & Company v. Estate of Murphy [2018 Mass. LEXIS 13].

[14] United States Code, s1715z-20(k).

[15] Interestingly, in PN Haridas v. The Corporation Bank [LNIND 2017 Ker 18039], the elderly mortgagors could not comprehend the valuations in their RML and ended up paying much more than what they initially believed. In addition, due to periodic valuations, the calculations in RMLs becomes very complex.